San Francisco Market Update - July 2023

July 17, 2023

Anthony Navarro

July 17, 2023

Anthony Navarro

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones.In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we’ve put together this monthly analysis breaking down specifics about the market.As we all navigate this together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you- Anthony Navarro, DRE #01491847

-------------------

Quick Take:

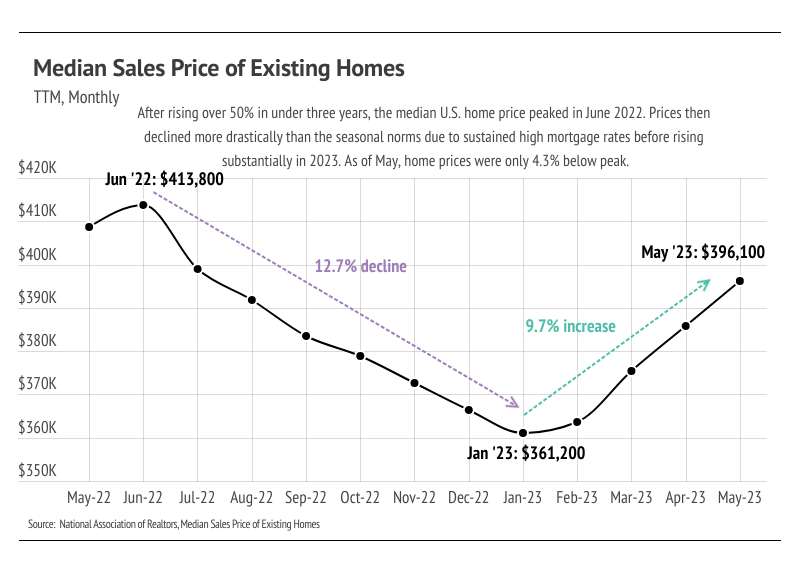

The median home price in the United States landed 4.3% below the all-time high reached in June 2022 after appreciating 9.7% in 2023. When accounting for current home prices and mortgage rates, the monthly cost of financing a home has never been higher.

As expected, the Fed chose not to raise rates in June but will likely raise rates at least two more times this year. We continue to expect mortgage rates to remain between 6% and 7% for the rest of 2023.

Broadly, housing inventory will likely remain historically low for at least three more years because of the high levels of sales and refinancing that occurred from June 2020 to June 2022.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

-------------------

-------------------

-------------------

-------------------

-------------------

-------------------

Stay up to date on the latest real estate trends.

February 19, 2026

February 9, 2026

February 9, 2026

February 9, 2026

February 9, 2026

February 9, 2026

November 4, 2025

February 24, 2025

January 24, 2025

You’ve got questions and we can’t wait to answer them.